If there is one piece of advice I could share with young generations is the importance of saving money while you’re young. I am targeting 20 year olds. Those people who are capable of working and earning some money. I know, you don’t make enough to save anything. I’ve been there myself. I guarantee that if you look hard enough you will find a few dollars to put aside. Maybe it’s that celsius you like drinking or those earrings you can’t live without. Now is the time to make the habit. Believe it or not you have the same amount of resilience that you do as a younger version of yourself. As you age you will be less tolerant of living frugally. You can afford to put money aside and you need to do it regularly. You also need to make it a habit to save and increase your savings to 20% of your income. When you get that raise, save more until you reach your goal.

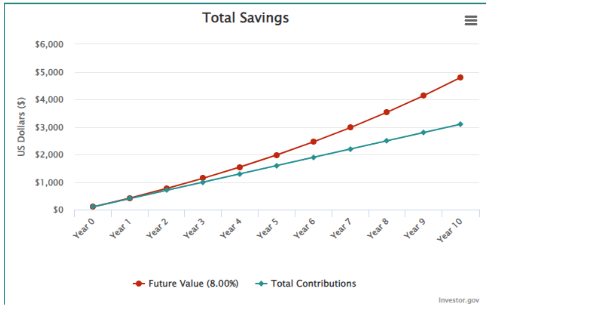

Besides being resilient, you have time on your side. Put your money to work immediately earning as much return as possible. We know that compounding interest is a critical component to building wealth. Here is a simple example of making a $100 investment earning 8% compounded monthly over a 10 year horizon.

Now here is that same formula over a 30 year horizon. That comes out to be an earnings of about $29k from a $9k contribution… almost 3 times the return.

Now imagine that you can afford to save more than $25/month. In fact as you make more money you save more. Let’s say you save $250 per month from age 26-30, then $500 per month from age 31-35, then $1000 from age 35-40, then $1500 from age 41 to 55, then $0 from 56-70. The power of compounding interest really starts to show itself. Of course after you retire you’d be living off your money so it’s unlikely that it would continue to build so fast but you get the point.